SARASOTA, Fla. (January 16, 2026) – The REALTOR® Association of Sarasota and Manatee (RASM) has released its year‑end 2025 real‑estate market report, offering a comprehensive look at housing activity in both counties. Throughout 2025 the region experienced contrasting trends between single‑family homes and condos/townhouses and between Sarasota and Manatee counties. Understanding these nuances is essential for buyers and sellers navigating today’s evolving market.

December 2025 data continued to emphasize these yearly trends. Sarasota’s single‑family market closed the year with 711 sales (up 17.7 percent from December 2024) and a median sale price of $485,000, while the condo/townhouse sector recorded 295 sales (up 15.2 percent) but saw its median price slide to $345,000. In Manatee County, December single‑family sales slipped to 612 homes (–5.6 percent) with a median price near $491,500, whereas condo/townhouse sales climbed to 244 units (up 13 percent) as the median price dipped to about $307,500.

“A lot of headlines consumers read are at the national or state level, and with real estate being hyper-local, those data points don’t give you much true insight into our local markets,” said David Crawford, 2026 RASM President and Broker/Owner of Catalist Realty. “Even in Sarasota and Manatee counties, as you can see from the year-end data, we truly have multiple markets, not only between single-family homes and condo or townhome properties, but also between resale inventory and new construction coming to market.”

Key Trends in Sarasota/Manatee Year-End 2025:

- Sales Activity: Sarasota County posted a 9.3 percent increase in single‑family home sales (8,183 sales), while its townhouse/condo segment declined 4.3 percent to 3,295 units. Manatee County showed the opposite pattern, with single‑family sales up just 0.5 percent (7,521 homes) and condo/townhouse sales up 4.8 percent (2,719 units).

- Median Sales Price: Single‑family median prices eased to $474,700 in Sarasota (–6 percent) and $475,000 in Manatee (–5 percent). Condo prices fell more sharply, dropping 15.3 percent to $325,000 in Sarasota and 8.6 percent to $310,000 in Manatee.

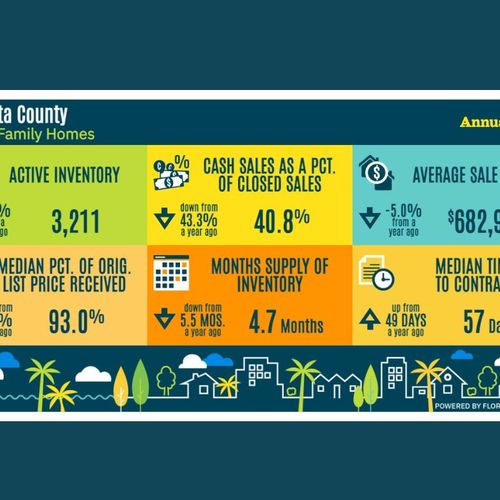

- Inventory: Sarasota’s single‑family inventory fell to 3,211 listings (4.7 months supply) while condo inventory expanded to 2,231 units (8.1 months). Manatee’s single‑family inventory increased to 2,687 homes (4.3 months), whereas condo inventory remained stable around 1,480 units (6.5 months).

- Speed of Sales: Homes generally took longer to sell compared with 2024. The median time to sale was 99 days for Sarasota single‑family homes and 104 days in Manatee. Condos experienced the slowest pace: 112 days to sale in Sarasota and 115 days in Manatee.

Single-Family Homes

Sarasota’s single‑family home market remained robust in 2025. Closed sales jumped to 8,183 transactions (up 9.3 percent), with 40.8 percent paid in cash. Despite the uptick in sales, the median price slipped 6 percent to $474,700, and the average price declined 5 percent to $682,999. Sellers received a median of 93 percent of their original list price. Inventory tightened to 3,211 active listings (4.7 months of supply).

Manatee County saw more modest single‑family results. Sales edged up 0.5 percent to 7,521 homes. Prices eased 5 percent to a median of $475,000 and 5.6 percent to an average of $635,041. Cash transactions comprised roughly 30.1 percent of sales, while sellers still obtained a median of 94.6 percent of their original asking price. Inventory climbed to 2,687 homes (4.3 months supply).

Townhomes and Condos

Sarasota’s condo and townhouse market cooled significantly. Closed sales fell 4.3 percent to 3,295 units. Cash purchases remained high with 64.7 percent of sales. The median price tumbled 15.3 percent to $325,000, while the average price declined 26.7 percent to $514,980, signaling a softening luxury condo market in 2025. Sellers accepted a median of 90.5 percent of their original list price. Active inventory expanded to 2,231 units (8.1 months supply).

In Manatee County, the condo/townhouse sector fared better. Closed sales increased 4.8 percent to 2,719 units, with 51.6 percent of sales being in cash. Even so, prices softened: the median sale price fell 8.6 percent to $310,000 and the average price declined 12 percent to $347,008. Sellers received a median of 92.6 percent of their original list price. Inventory stayed roughly level at 1,480 units (6.5 months supply).

Summary

The 2025 figures highlight that there is no single narrative for the Sarasota–Manatee housing market. Single‑family homes remained resilient, with modest price easing and healthy sales volumes. Condos and townhomes, particularly in Sarasota, faced significant price adjustments and slower sales. These contrasting dynamics illustrate why working with a REALTOR® who understands local nuances is critical. Market conditions vary by county, property type, and even neighborhood, so buyers and sellers need individualized guidance from professionals who can interpret localized trends and help them make confident decisions.

Monthly reports are provided by Florida Realtors® with data compiled from Stellar MLS. For comprehensive statistics dating back to 2015, visit www.MyRASM.com/statistics.