Written by The Pope Team | Christine Pope & Paul Pope

Picture this: You've found your dream home in Sarasota. The kitchen overlooks a gorgeous lanai, the location is perfect, and you can already imagine yourself enjoying coffee on that screened porch. Then your agent calls with news—there are multiple offers. Suddenly you're wondering: Should I waive my inspection? Would dropping contingencies make my offer stand out?

I'll admit, I've had these conversations with buyers more times than I can count, especially when Sarasota's market gets competitive. And while I understand the urge to make your offer as attractive as possible, the answer isn't quite as simple as yes or no.

What Contingencies Actually Protect You

The most common contingencies in Florida real estate contracts are the inspection contingency, the appraisal contingency, and the financing contingency. Each one exists for a specific reason—to protect you financially if something goes wrong.

The inspection contingency gives you time (typically 10-15 days in Sarasota) to have the home professionally evaluated. This isn't just about finding deal-breakers like foundation issues or a failing roof—it's also your chance to understand what you're really buying, from the age of that air conditioning system to whether the pool equipment is functioning properly.

The appraisal contingency protects you if the home doesn't appraise for the purchase price. If you're financing and the home appraises low, your lender won't loan you the full amount. Without this contingency, you'd need to either come up with the cash difference or walk away from your deposit.

The financing contingency ensures that if your loan doesn't come through despite your pre-approval, you can exit the contract and get your deposit back.

When Waiving or Shortening Makes Sense

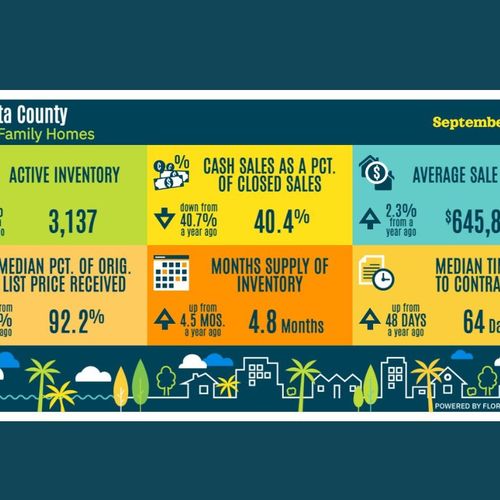

If you're a cash buyer, you're already in a stronger position. Waiving the appraisal contingency is fairly low-risk since you don't need lender approval. Some cash buyers also feel comfortable waiving inspections if they've thoroughly toured the property and it's relatively new or well-maintained.

For financed buyers, shortening inspection timelines from 15 days to 7 days can show sellers you're serious while still giving you protection. You might also consider an informational inspection only—meaning you still inspect the property but agree not to ask for repairs or credits based on the findings.

The Risks You Need to Understand

Here's where I need to be completely honest with you. Waiving contingencies in Sarasota comes with real financial risk.

Florida homes have specific issues you might not encounter elsewhere. Our climate means air conditioning systems work overtime and may need replacement sooner than you'd expect (typically every 10-15 years). We have unique concerns like termites, moisture intrusion, and older homes that may not have been built to current hurricane codes.

I've seen buyers waive inspections only to discover after closing that they need a $35,000 roof replacement or that there's active water damage behind the walls. In competitive markets, some buyers take this gamble and win—the house is fine. But when you lose that gamble, it's expensive.

The appraisal risk is equally real. If you've waived this contingency and can't cover the gap with cash, you could lose your deposit—which in Sarasota typically runs $15,000 to $30,000 or more, depending on the purchase price.

A Better Strategy: Get Informed First

Rather than blindly waiving protections, do your homework first. Pull the property's permit history to see what major work has been done. Review the seller's disclosure carefully. If the home has an HOA, read through recent meeting minutes and reserve studies.

If you're considering waiving the inspection, you might hire an inspector to do a pre-offer walkthrough. Yes, you'll pay for an inspection on a home you don't own yet, but if it helps you make an informed waiver decision, that few hundred dollars could save you tens of thousands.

What Actually Makes an Offer Competitive

Here's something buyers don't always realize: Price still matters most. A clean, full-price or above-asking offer with normal contingencies often beats a lower offer with contingencies waived.

Beyond price, these factors strengthen your position:

- A strong pre-approval letter from a reputable local lender

- Flexibility on closing dates to match the seller's timeline

- A larger earnest money deposit

- Proof of funds if you're claiming to cover any appraisal gaps

The Bottom Line

Can you waive contingencies or shorten timelines to be more competitive? Yes, you absolutely can. Should you? That depends entirely on your financial situation, risk tolerance, and the specific property.

I'd encourage you to have an honest conversation with your real estate agent about the risks and benefits for your particular situation. A good agent (like us!) will help you craft a competitive offer that protects you as much as possible while still giving you the best shot at winning the home.

If you're navigating a competitive offer situation here in Sarasota and want to talk through your options, give us a call or schedule a time to chat. We've helped dozens of buyers through exactly this scenario, and we'd love to help you figure out the right strategy for your dream home.

Remember: The goal isn't just to win the house—it's to win it on terms that make sense for you and your future.

Written by Paul Pope, Realtor with Michael Saunders & Co., serving Sarasota, Lakewood Ranch, and Bradenton, Florida. 941-685-1156 | [email protected]