The Pope Team’s Complete Buyer Budget Guide

I'll admit, moving to Sarasota from Michigan many years ago opened my eyes to how different home prices can be from one area of the country to the next, and made me laser-focus on what I could afford here. True affordability means more than just the list price—it’s about knowing the whole picture. Chances are you’ve bought and sold homes in the past, and it doesn’t hurt to have a little refresher.

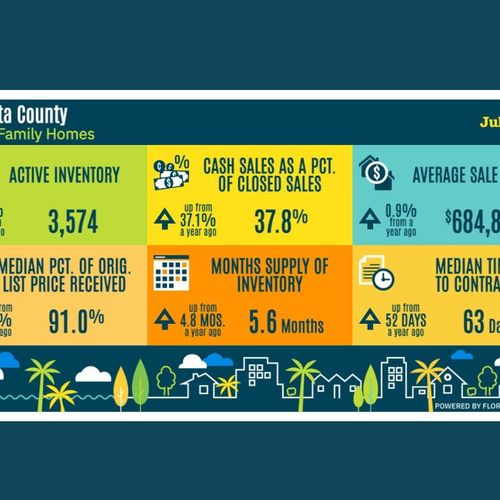

The Real Cost of Homeownership in Sarasota

Monthly mortgage payments are just the start—Sarasota comes with a few unique expenses:

- Insurance: Being in paradise means insurance rates vary widely. Coastal properties or homes in flood zones could run you $200–$800 or more per month for coverage. We will help you minimize this cost through careful attention to flood zones, wind-resistant features, and other items, such a the age of a home’s roof, that could make or break your insurance budget.

- HOA/Community Fees: Desirable neighborhoods often have HOAs. Fees start around $50/month but can top $500 in places like Lakewood Ranch or The Oaks. In condo communities, the monthly fees are often between $500 to over $1,000 per month. For more info on these fees, please see our blog post Making Sense of Condo Fees in Sarasota.

- Property Taxes: The exact formula is complex, but a rule of thumb I find helpful is to figure about 1.2% of the price of the house will be the approximate annual property taxes. On a $1M home, roughly figure $12,000 annually in property taxes. There are some exemptions available such as the Florida Homestead Exemption, Seniors, Disability, Veterans, and others.

Does the 28% Rule Apply?

Lenders love the rule: keep housing below 28% of gross monthly income. This ratio helps keep a little extra money in your pocket for other things. You may be encouraged to know that Sarasota’s lifestyle—beaches, parks, and more free activities—might make spending a little extra on housing entirely comfortable, especially if local perks replace previous big-city expenses.

Get Pre-Approved First

Before home tours, start with pre-approval. Sarasota lenders know the area’s quirks and can help you find the right fit—including programs for out-of-state buyers making a big move. We can help you find a great, local lender and you are also welcome to use your own bank, just be sure they are licensed to lend in Florida.

What Different Price Ranges Buy

- $400–$500K: Older homes in established neighborhoods and some new condos or townhomes—great bones, maybe some updating required. Try The Meadows

- $600–$800K: Newer builds, golf communities, and homes with pools or upgraded finishes. Community amenities are common. Think Gulf Gate.

- $1M-3M: Larger homes with luxury outdoor spaces, and top-tier neighborhoods. Example: The Landings or Cherokee Park

- $3M-$5M: Top tier neighborhoods, elegant interior upgrades, fully landscaped lots, some with water views and water access, extra garage space. Think Harbor Acres.

- 5M+: Waterfront properties, boating access, upscale interiors. Think Siesta Key, Lido Key, Longboat Key, or Bird Key.

Extra Costs to Budget For

Be prepared for moving expenses (especially if relocating), vehicle registration, utility deposits, pool maintenance ($100–$150/month), and landscaping, which will be year-round and ongoing in Sarasota’s climate.

Key Questions Before You Start House Hunting

- Beach access or bigger space inland?

- Planning to entertain? Want a pool or lanai?

- Need a home office or room for visiting family?

Next Steps

When you’re ready to chat about timelines and what’s possible for your budget, let’s connect. No pressure—I want you to feel confident in your numbers, so when we do start looking, we’ll find a home that really fits your Sarasota lifestyle. If and when you’re ready for your own private VIP tour of homes that interest you, we would love to be your local expert Sarasota real estate agent. Email us today with your search criteria, or schedule a call with us and let’s get started!